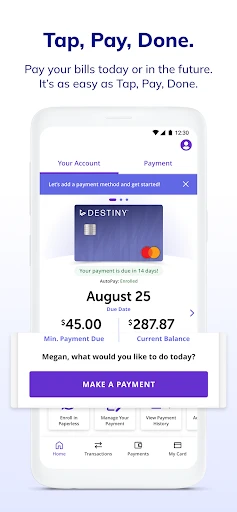

Let's talk about the Concora Credit app, a nifty tool in the financial tech world that's gaining quite a buzz. If you're like me and love managing finances with a tap of a button, this one's for you. I've spent some time exploring the app, and here's the lowdown.

Getting Started with Concora Credit

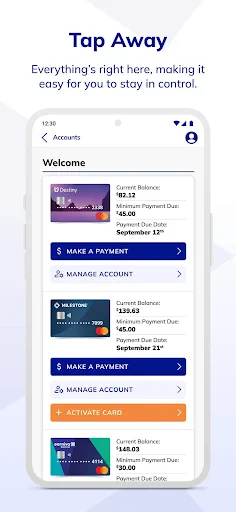

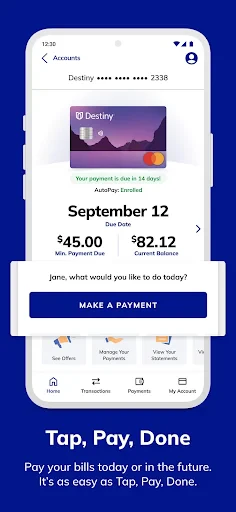

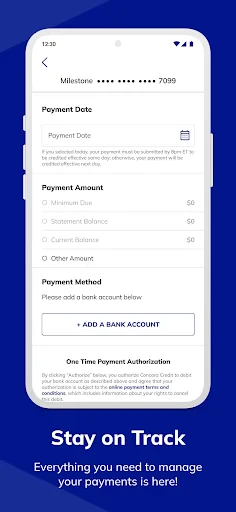

First things first, downloading the Concora Credit app was a breeze. Available on both Android and iOS, it took no time to install and set up. The interface is sleek and user-friendly, which is always a plus in my book. During the initial setup, I was guided through a straightforward registration process. The app also provides an option to link your existing bank accounts, which is where the magic begins.

Features That Stand Out

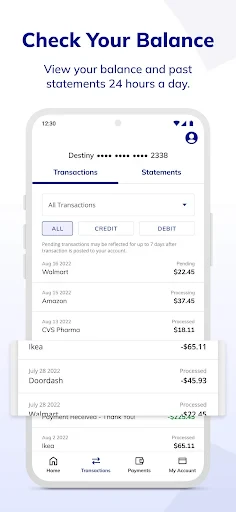

One feature I found particularly useful is the budgeting tool. It’s like having a financial advisor in your pocket. The app tracks your spending habits and gives you insights into where your money is going. I was pleasantly surprised by how intuitive it is. Set your budget limits, and the app will notify you when you're close to overspending. It's like having a financial guardian angel!

Another cool feature is the credit score tracker. We all know how crucial maintaining a good credit score is, and with this app, checking your score is as easy as pie. It even provides tips on how to improve it. I found this feature empowering, especially if you’re working towards a financial goal like buying a house or a car.

The User Experience

Using the app feels seamless. I love how everything is organized and easy to find. The app has a calming color palette that makes navigating through your finances a less daunting task. There's also a support feature that connects you to customer service reps if you ever find yourself in a pickle.

I did notice that sometimes the app takes a moment to sync data with my bank, but it’s a minor hiccup in an otherwise smooth experience. Plus, the developers seem to be on top of regular updates, which is reassuring.

Final Thoughts

In a nutshell, if you're on the lookout for a reliable and user-friendly financial management tool, Concora Credit should be on your radar. It's packed with features that make managing money not just easier but also smarter. I’d definitely recommend giving it a whirl, especially if you want to keep tabs on your spending and improve your financial health.

Overall, my experience with the app has been quite positive. It's a great addition to my financial toolkit, and I think it might just be the app you didn't know you needed!