Cash Cow

4.4 Entertainment Updated January 7th, 2026

Have you ever wondered if managing your finances could be as fun as playing a game? Well, let me introduce you to Cash Cow, the app that's here to transform the way you handle your money. As someone who's always looking for ways to keep my financial life in check without the stress, I decided to give this app a whirl, and I’m here to spill the beans.

Getting to Know Cash Cow

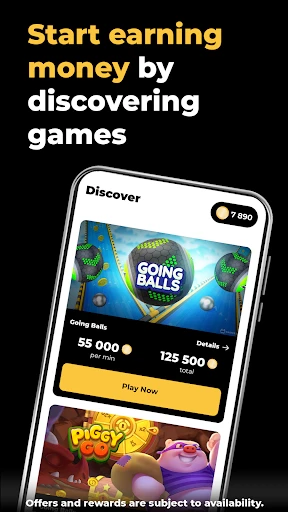

First things first, Cash Cow isn't your typical money management app. It’s designed to make saving and budgeting a lot more engaging. The app gamifies the whole process, which means you’re not just crunching numbers—you’re also having a bit of fun along the way. When you download and open the app, you’re greeted with a vibrant interface that’s both intuitive and pleasing to the eye. It’s like having a financial advisor who’s fun at parties!

The Features That Moo-ve You

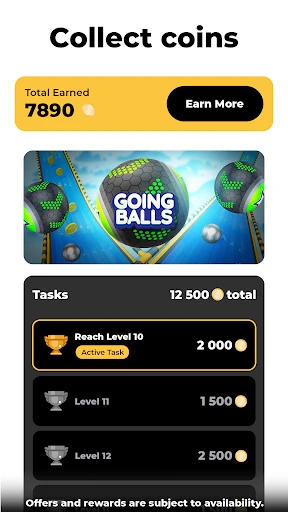

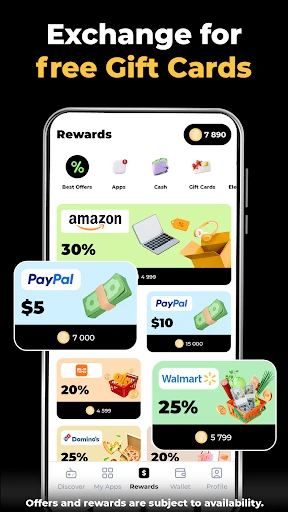

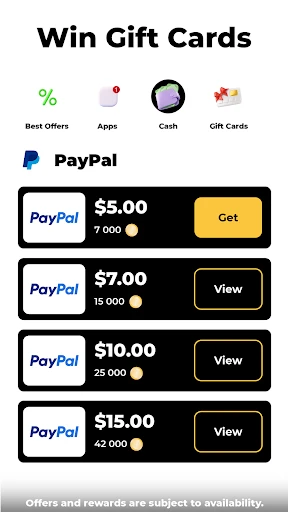

One of the features that caught my attention was the "Challenge Mode". You can set personal financial goals or join community challenges. Whether it's saving for a vacation or paying off a debt, these challenges keep you motivated. Plus, you earn badges and rewards as you progress, which is a nice little pat on the back.

Another aspect I found super useful is the budgeting tool. It’s straightforward and helps categorize your expenses efficiently. You can link your bank accounts for automatic updates, which means less manual entry and more accuracy. The app sends you notifications and insights on your spending habits, making it easier to identify where those extra bucks are slipping away.

My Experience with Cash Cow

Using the app feels like having a personal accountant who’s also a bit of a cheerleader. I enjoyed how it simplifies tasks that typically feel daunting. The game-like elements kept me engaged, and I found myself looking forward to checking the app to see my progress. It was rewarding to see my savings grow and my goals getting closer to completion.

However, like any app, it’s not without its quirks. Occasionally, I noticed a slight delay when syncing with my bank accounts, but it wasn’t anything a quick refresh couldn’t fix.

Final Thoughts

All in all, Cash Cow is a fantastic tool for anyone looking to take control of their finances without the usual dread that comes with budgeting. Its engaging format makes it appealing not just to budget nerds, but also to those who might shy away from traditional finance apps. If you’re ready to make budgeting less of a chore and more of an adventure, give Cash Cow a try. You might find that managing money can be a lot more enjoyable than you ever thought possible!

Screenshots